As Litecoin tests a multi-year trend following almost 5-months of sell pressure, large institutions have not been sitting idly by; acquiring thousands of coins on the cheap.

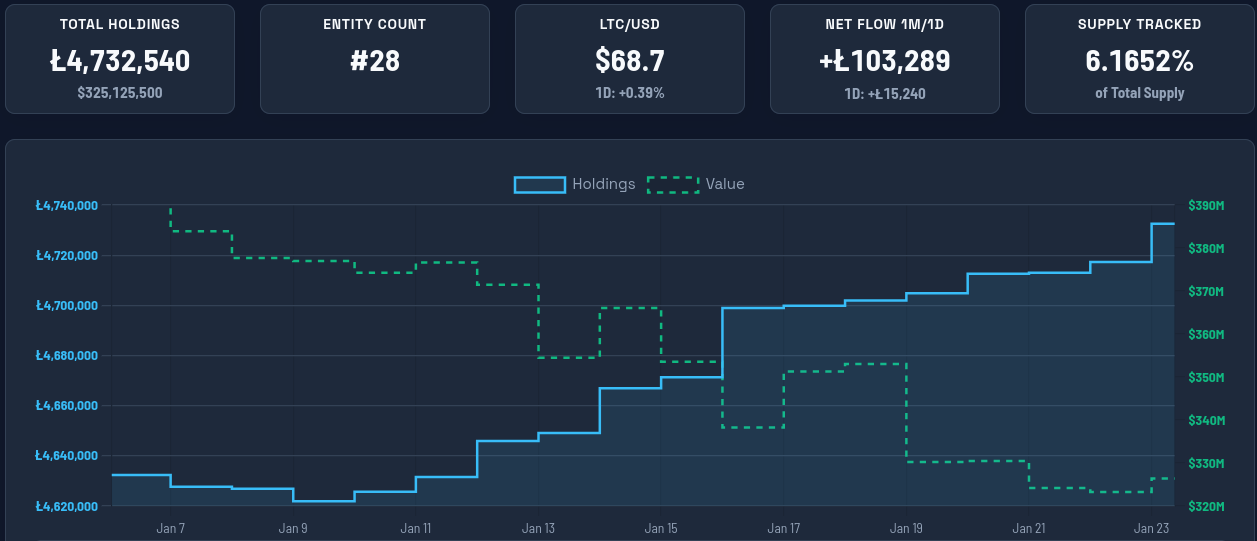

On a monthly basis, net Litecoin flows surged to 103,289, with another 15,240 coins being taken out of circulation in the last 24 hours alone, according to data from litecoinregister.com. These holdings amount to a whopping 6.1% of the total supply, which is fixed at 84 million coins – forever.

Whether it’s accumulation from large institutions, or by private individuals and family offices, Litecoin’s illiquid supply is clearly on the rise.

In other words, the number of coins available to purchase on the open market is rapidly declining as absorption into financial products and MWEB ticks higher.

MWEB usage rises

From a quasi-retail point of view, coins in Litecoin’s privacy feature (MWEB) have also been on the rise, with around 32,200 coins entering the privacy layer in January; an 8% increase.

Coins in MWEB are defacto taken out of circulation and cannot be used as collateral on exchanges since support for the privacy layer is only deployed on self-custodial wallets presently.

At the time of writing, Litecoin holdings using the MWEB feature stands at 432,221 LTC, an accrued value of almost $30 million, per data from the mwebblockexplorer.com.

Repricing digital silver

As noted in a detailed report from Luxxfolio Holdings – one of two Litecoin Treasury companies – LTC/USD is projected to face steep structural repricing moving forward to better reflect the underlying value of the network, and its pristine track record.

The rationale is in part based on significant a price-fundamentals discrepancy typified by the coin’s strong settlement and monetary throughput and a spot price that’s yet to catch up to this economic demand.

Looking at total onchain settlement, Bitcoin transferred approximately $28.7 billion in the last 24 hours — about 1.61% of its market cap. Litecoin transferred $2.3 billion, representing roughly 44% of its market cap.

For a network of Litecoin’s size, this level of monetary throughput is exceptionally strong. The 24-hour transaction distribution illustrates consistent, broad economic activity across the network.

The report goes on to note that fair value for Litecoin approaches 5-digit territory, around $10,000 per coin.

Valuation models based on transaction volume and user activity suggest a potential fair value near $9,000–$10,000 per LTC, highlighting the significant disconnect between fundamentals and price.

LTC/USD currently exchanges hands at ~$68–$69; a fire-sale valuation if there’s ever been one.

The broader question as to whether Litecoin will close the gap with Bitcoin is often viewed in light of the sound money adage that ‘price eventually follows fundamentals’. And litecoin certainly provides compelling fundamental data-sets, enough to induce visibly surging institutional and, to a lesser extent, retail interest in the network.

If you found this article useful, consider sharing it.