The immediate outlook for Litecoin might seem bleak to some analysts today, but the long-term technical picture, buttressed by impeccable fundamentals, suggests underlying strength that shouldn’t be ignored.

Strong technical undercurrents

Earlier in January, the LTC/USD pair witnessed a golden cross. This technical indicator occurs when a short-term moving average crosses above a longer-term moving average, suggesting a positive trend change. In this case, the 50-week exponential moving average (EMA) crossed above the 200-week EMA, reflecting a shift in momentum.

At the same time, the Bollinger Band %b technical indicator, which shows the position of current price relative to the upper and lower Bollinger Bands, indicates oversold conditions (below 0) on a weekly timeframe.

While Litecoin price-action has been range-bound all year, longer-term price has continued to print higher lows commensurate with its 8-year flag-pole structure.

Impeccable fundamentals

Together, these technical indicators show that while price chops and hits wild swings, in large-part due to secondary market deleveraging events, Litecoin is at an incredibly attractive price point.

Unlike most other blockchains, which boast fundamentals as deep as a puddle on a hot day, Litecoin’s positive technical picture does not exist in a vacuum.

Indeed, Litecoin’s fundamental picture is both attractive and profoundly understated, with the network consistently processing almost half as many transactions as Bitcoin on a daily basis, per data from bitinfocharts. In fact, all on-chain metrics printed positive data in 2025 (as well as prior years), whether it be an increase in hashing power (and therefore network security), or an uptick in MWEB usage – Litecoin’s privacy feature.

Traditional finance quietly stacks Litecoin

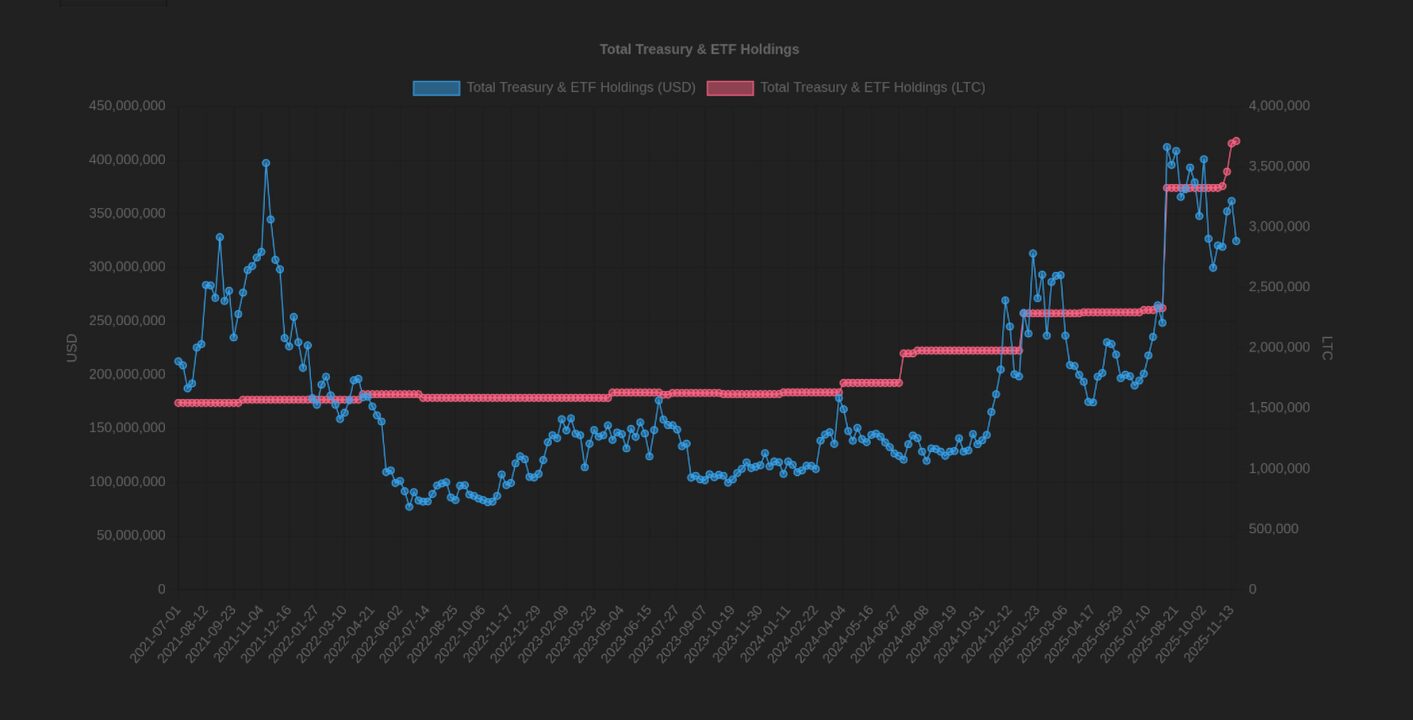

On the tradfi front, Litecoin has grabbed the attention of Corporate Treasury companies like Lite Strategy and Luxxfolio Holdings, which are adding coins to their balance sheet, thereby decreasing the available supply in the open market.

According to litecoinregister.com, the total amount of Treasury and ETF Litecoin holdings now stands at 3.7 million coins, nearly double the amount held year-on-year at the time of writing.

If you found this article useful, consider sharing it.