Cryptocurrencies have come a long way since the early days, and the pendulum is poised to swing away from short term speculation to the fundamental value propositions, such as that offered by Litecoin.

In a new paper, seasoned observers have turned their attention to establishing grounded principles for assessing long-term value. The research paper “Silver Standard,” published by LitVM, presents a thought-provoking valuation framework which identifies Litecoin as a first-generation “legacy” cryptocurreny as a foundational asset in the digital economy.

Authored by crypto veterans with deep experience in the space, the document shifts focus from speculative vapourware to fundamentals. It argues for a mature approach to valuation, particularly as it relates to Litecoin ($LTC), which the authors position as an unequalled frontrunner in this category.

By examining four key criteria, the report offers a blueprint for understanding which assets have weathered the storms, providing clarity for investors looking for real value beyond the usual, mindless dopaminergic drivel peddled online.

The Fundamental Value Proposition (FVP) Paradigm in Cryptocurrency

The authors begin by contextualising the current state of the market, emphasising a significant shift away from its earlier, more volatile phases. They note that the cryptocurrency market has entered into a new paradigm which is no longer based on hype-chasing and memetic, flavour-of-the-week, gambling. Instead, as the report states,

“we are witnessing the emergence of a more institutionalised and utility-driven ecosystem, where durability, scalability, and real-world applicability take precedence over transient narratives.”

According to the authors, this evolution marks a departure from the boom-and-bust cycles driven by flash-in-the-pan speculative bubbles and all the dangerous trappings of short-termism.

In the coming environment, the focus has turned to assets that demonstrate resilience, reliability and practical utility, much like traditional commodities such as silver have historically served as stores of value and mediums of exchange.

The report underscores that this paradigm shift invites a more rigorous valuation framework – one that prioritises longevity over immediate gains.

Four Criteria for Identifying Foundational Coins

At the heart of the “Silver Standard” framework are four well-defined criteria for distinguishing legacy coins – those cryptocurrencies with the potential to become enduring pillars of the digital economy. These criteria are designed to filter out fleeting trends and highlight assets with intrinsic strengths and a track record to prove it. The authors elaborate on each criterion, drawing on historical parallels and technical analysis to build their case.

- Durability and Proven Track Record: The first criterion stresses the importance of an asset’s ability to withstand market cycles without succumbing to obsolescence. As the report observes,

“A legacy coin must exhibit anti-fragility-emerging stronger from volatility-supported by a history of consistent uptime, security audits, and community stewardship spanning multiple market phases.”

This durability is not merely about survival but about fostering trust through transparency and reliability.

- Scalability and Efficiency: Here, the emphasis is on technical robustness to handle growing demands without compromising performance. The authors assert that

“scalability remains the Achilles’ heel for many blockchains, but legacy coins must deliver low-latency transactions at minimal cost, akin to silver’s role in everyday commerce rather than gold’s ceremonial reserve status.”

They highlight metrics such as transaction throughput and energy efficiency as benchmarks for this criterion.

- Adoption and Network Effects: The third pillar evaluates the breadth and depth of an asset’s ecosystem. Quoting the report:

“True legacy status demands widespread adoption, evidenced by merchant integration, developer activity, and cross-chain interoperability, creating a virtuous cycle of network effects that propel organic growth.”

This criterion moves beyond raw user numbers to assess genuine utility and interoperability in a multi-asset world.

- Monetary Properties and Economic Incentives: Finally, the framework examines an asset’s alignment with sound monetary principles. The authors explain,

“A digital silver must balance scarcity with accessibility-fixed supply models paired with predictable issuance schedules-to incentivise holding and usage, while mitigating inflationary pressures that erode value over time.”

This includes evaluating tokenomics that reward long-term participants without introducing undue centralisation.

Together, these criteria form comprehensive optics for valuation, per the authors, encouraging a view that integrates technology, economics, and social phenomena.

Why Litecoin is Well Positioned

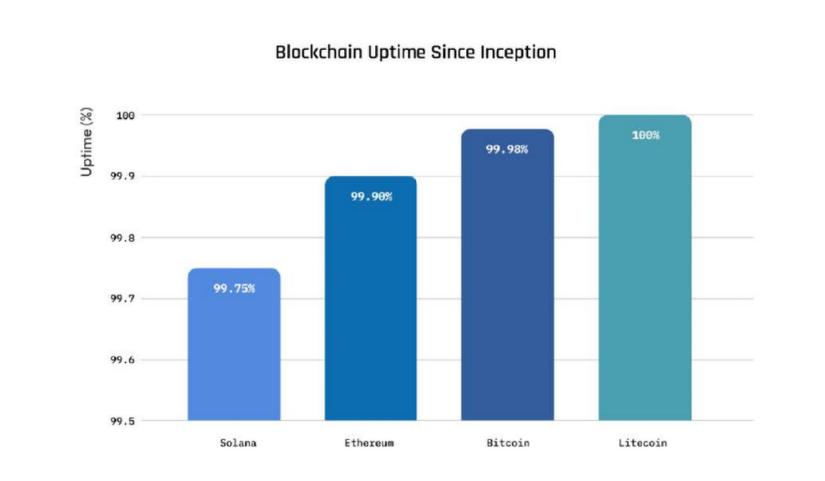

Applying this framework, the report positions Litecoin as exemplifying the qualities of a legacy coin, particularly in its aspiration to embody a “digital silver standard.” With origins tracing back to 2011, LTC benefits from an established track record that aligns closely with the durability criterion. The authors praise its “unwavering commitment to security and uptime, having processed billions in transactions without a single major breach.“

On scalability, Litecoin’s Segregated Witness upgrade and MimbleWimble Extension Blocks (MWEB) are highlighted as forward-thinking enhancements. As the report notes, “LTC’s efficient protocol enables sub-second confirmations at fractions of a penny, positioning it ideally for micropayments and everyday use-far removed from the congestion plaguing less optimised networks.“

Regarding adoption, the authors point to Litecoin’s integration with payment processors and its role in broader crypto infrastructure, stating, “with a vibrant developer community and partnerships spanning exchanges and wallets, LTC’s network effects continue to compound, fostering real-world utility beyond speculation.“

Finally, Litecoin’s monetary design-featuring a 84 million coin cap and quarterly halving events-exemplifies strong economic incentives.

The report concludes on this front: “LTC’s predictable scarcity model, combined with its accessibility, mirrors silver’s historical utility, making it a natural fit for a portfolio seeking stability in digital form.“

In essence, the authors argue that Litecoin’s staunch adherence to these criteria not only secures its place in the current market but also charts a path for sustained relevance and growth in a maturing industry.

Read the full report here.

If you found this article useful, consider sharing it.