One of the most far-reaching trends in the financial space right now is the imminent roll out of Central Bank Digital Currencies (CBDCs), and the simultaneous attacks against bitcoin and cryptocurrencies as they ready the launch of CBDCs.

What is a CBDC?

To avoid confusion, let’s distinguish between CBDCs and digital fiat currency, which are not the same thing.

A CBDC refers to virtual central bank (fiat) money that is created as a digital token or account balance. These are also digital claims on the central bank (IOUs), and CBDCs will be issued directly by central banks as legal tender.

Many CBDCs that are in development purport to use a form of Distributed Ledger Technology (DLT), keeping a record of transactions on a blockchain. However, unlike decentralised cryptocurrencies like Bitcoin, Litecoin and Monero which use a permissionless and open design, CBDCs that use this technology will be permissioned variants, thus deciding who can access the network and who can update records in the ledger.

As such, the difference between permissionless and permissioned blockchains could not be more important in a world that is fast turning to digital payment methods.

As the name suggests, CBDCs are completely centralised and governed by the issuing authority (i.e. a central bank). By design and structure, CBDCs are the very antithesis to decentralised cryptocurrencies and tokens – the most widely used one being Bitcoin.

Central banks have been working on two types of CBDCs, ‘wholesale’ digital tokens that would have access solely for banks and financial entities (for interbank settlements), and ‘general purpose’ (retail) CBDC for the general public to be used in every day transactions.

When discussing CBDCs, most people refer to general purpose usage, as this will directly affect the billions of people that will come to use them world wide.

As you can imagine, account-based CBDCs will be tied to user identities and Digital IDs, i.e. right off the bat, they allow for total surveillance by the State and completely exhume any chance of anonymity and privacy. For this reason, CBDCs are very popular with central banks. Given that CBDCs will be centralised ledgers, and can be programmed at will, ‘digital cash’ tokens defacto remove privacy and freedom by design.

At this stage, there is no reason to believe that central banks will opt for a hybrid model of both account-based and token based digital cash. For instance, Canada – once a liberal democracy – illustrates that CBDCs are entirely about surveillance and control, with the Central Bank of Canada saying that:

“anonymous token-based options would be allowable for smaller payments, while account-based access would be required for larger purchases.”

Central banks are also experimenting with different models for distribution of CBDCs to the masses, including using commercial banks and payment providers who will intermediate on central banker’s behalf. The rollout mechanism is not set in stone, however, and will likely involve several approaches to onboard the maximum amount of people into the regime.

Either way, CBDCs in their current form greatly facilitate the statist’s wet dream to advance plans for Universal Basic Income (UBI), and total dependency on the state by extension.

Coming at Lightning speed

Unfortunately, CBDCs are not simply a buzzword for something that may or may not happen in the distant future. They are in active development and are widely popular among central bankers.

In January 2020, the Bank for International Settlements (BIS) issued the results of a survey on CBDCs that it conducted in the second half of 2019, to which 66 central banks had answered. Notably, 10% of central bank respondents (representing a fifth of the world’s population) said that they were likely to issue a ‘general purpose’ CBDC within the next 3 years. Another 20% of respondents said they would issue a ‘general purpose’ CBDC within 6 years.

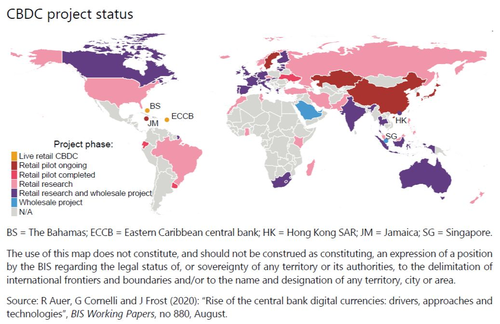

In August 2020, the BIS published a comprehensive paper on CBDCs titled “Rise of the central bank digital currencies: drivers, approaches and technologies”. One section analysed the BIS database of central banker speeches and found that between December 2013 and May 2020, there had been 138 central banker speeches mentioning CBDCs. This was a dramatic uptick since 2016, which coincides with central banks launching research projects into the technology.

The same report also underlined – naturally completely coincidentally – that the so-called pandemic “accelerated work on CBDCs in some jurisdictions.”

Fast forward to today and a website dedicated to tracking the launch of CBDCs shows country-by-country progress.

Per data from the Atlantic Council, 5 central banks have already launched a CBDC, 14 have a pilot project, 16 have one in development and another 32 are in the research stage with their CBC. In total, 67 central banks (countries) are moving ahead with plans to roll out CBDCs. While the 5 areas that have launched are all islands in the Caribbean, central banks at the pilot stage include global heavy weights like Communist China, South Korea, Thailand, Saudi Arabia and Sweden.

Those at the developmental stage include the central banks of Canada, Russia, Brazil, Turkey, France and Nigeria. Countries at the research stage include the central banks of the US, UK, Australia, Norway, India, Pakistan and Indonesia.

As you can see, this is not a hypothetical scenario. Centrally controlled digital currencies will be appearing within a year if not months from now. And given the ease with which governments have successfully imposed draconian measures without any scientific or logical leg to stand on, it’s not a stretch to imagine compliant populations embracing CBDCs as being in their ‘best interests’.

Anyone with a brain and the will to use it will know that this is rarely ever the case.

BIS Switzerland wants to rewrite the rules

A third of the Bank of International Settlements (BIS) report 2021 is focused on CBDCs in a section titled “CBDCs: an opportunity for the monetary system“.

In the report, the BIS trumpets the benefits of introducing such a technology issued by central authorities, while simultaneously attempting to undermine decentralised cryptocurrencies.

The BIS highlights a central banker’s worst fear – competition – noting that the threat of cryptocurrencies have accelerated the development of CBDCs. An excerpt reads: “Central bank interest in CBDCs comes at a critical time. Several recent developments have placed a number of potential innovations involving digital currencies high on the agenda.

The first of these is the growing attention received by Bitcoin and other cryptocurrencies; the second is the debate on stablecoins; and the third is the entry of large technology firms (big techs) into payment services and financial services more generally.”

The BIS then attempts to dismiss all three.

Cryptocurrencies, claims the BIS “are speculative assets rather than money, and in many cases are used to facilitate money laundering, ransomware attacks and other financial crimes”.

Bitcoin comes in for some special mention with the BIS saying that “Bitcoin in particular has few redeeming public interest attributes when also considering its wasteful energy footprint’.

Stablecoins, “attempt to import credibility by being backed by real currencies” that are “ultimately only an appendage to the conventional monetary system and not a game changer,” says the BIS.

The entrance of big tech firms which dominate social networks, internet search engines, messaging and e-commerce into financial services and payments is not well received by the BIS either. The report unironically attempts to twist criticism into an argument about “further concentration” of power in the market for payments.

Since then, Twitter has openly accepted Bitcoin and opted to introduce a tipping function for all. The CEO has been an open advocate of Bitcoin and its development.

Want to acquire Bitcoin, Litecoin and other crypto? Start here.

Of course, the irony is not lost on the fact that the BIS – the central bank of central banks – is criticizing tech giants for having too much “concentration” of power.

In the CBDC sales pitch, the BIS report refers to several instances where digital currencies should be in “in the public interest”, which actually means that they should be controlled by the BIS and its central bank members, as well as perpetuate their centralised monetary power.

The BIS goes on to say that it should respect privacy rights, despite the fact that its whole architecture and rationale would allow central banks to intrude on anyone’s private financial history by design.

During an interview, however, the general manager of he BIS, Agustin Carstens – often regarded as the final bitcoin boss in online bitcoin chat groups – chillingly admitted the end goal of CBDCs.

He said: “We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.”

This sentiment is shared within the entire organisation. Benoit Coeure, the head of the BIS innovation Hub, gave a speech about CBDCs in early September, acknowledging the convenient catalyst of the so-called covid pandemic, noting that this accelerated the development of CBDCs.

“the world is not returning to the old normal. Payments are a case in point. The pandemic has accelerated a longer-running move to digital …. the world’s central banks are stepping up efforts to prepare the ground for digital cash – central bank digital currency (CBDC):

“A CBDC’s goal is ultimately to preserve the best elements of our current systems while still allowing a safe space for tomorrow’s innovation. To do so, central banks have to act while the current system is still in place – and to act now.”

Red flags from China’s Digital Yuan

If that wasn’t enough information to increase skepticism about these projects, China’s Digital Yuan roll-out already shows that such currencies will not be in people’s best interests.

The ‘Digital Yuan’ can be programmed to be activated on a specific date, to expire on a certain date, to be valid for certain purchases, and ominously programmed to be available to citizens that meet certain per-conditions. Most likely, China’s social credit system will be implemented with the digital yuan in some form or another.

The details of this project reveal that central banks will have tolls to influence behaviour of the recipients of this digital cash, as well as exclude those who do not have a high enough social credit score, or who do not comply with the state’s rules or parameters.

Just recently, China announced yet another ban on cryptocurrency transactions as it paves the way for its upcoming authoritarian Digital Yuan amidst major struggles in the regime’s property crisis.

Is this the future Westerners want to sign up for?

Fool me once, shame on you. Fool me twice, shame on me.

While central banks claim one thing, they invariably do another. The sales pitch for CBDCs often involves improving payment efficiency, boosting financial inclusion for the unbanked and tackling illegal activity. But in practice, the trade off is total surveillance, control and abdication of any financial agency for individuals.

Surveillance of a population takes place via complete visibility into personal financial histories, transaction flows and user identities. With a cashless financial system and total control of the money supply all under one roof, the probability for CBDCs turning into a global dystopian nightmare is effectively guaranteed, with top officials at the BIS confirming our worst fears time and again.

And with the health-purposes of vaccine passports being non-existent, the only explanation that makes sense is that these digital health passes are merely a stepping stone for central bank digital currencies, and a China-style social credit system.

The ever-lasting question remains at the feet of the individual: do you want a future of monetary freedom, or a future of perpetual slavery to central banks and CBDCs? The choice is yours.

Subscribe to the semi-weekly newsletter for regular insight into bitcoin and crypto. Go on. It’s free.

Join the telegram channel for updates, charts, ideas and deals.

Did you like the article? Share it!