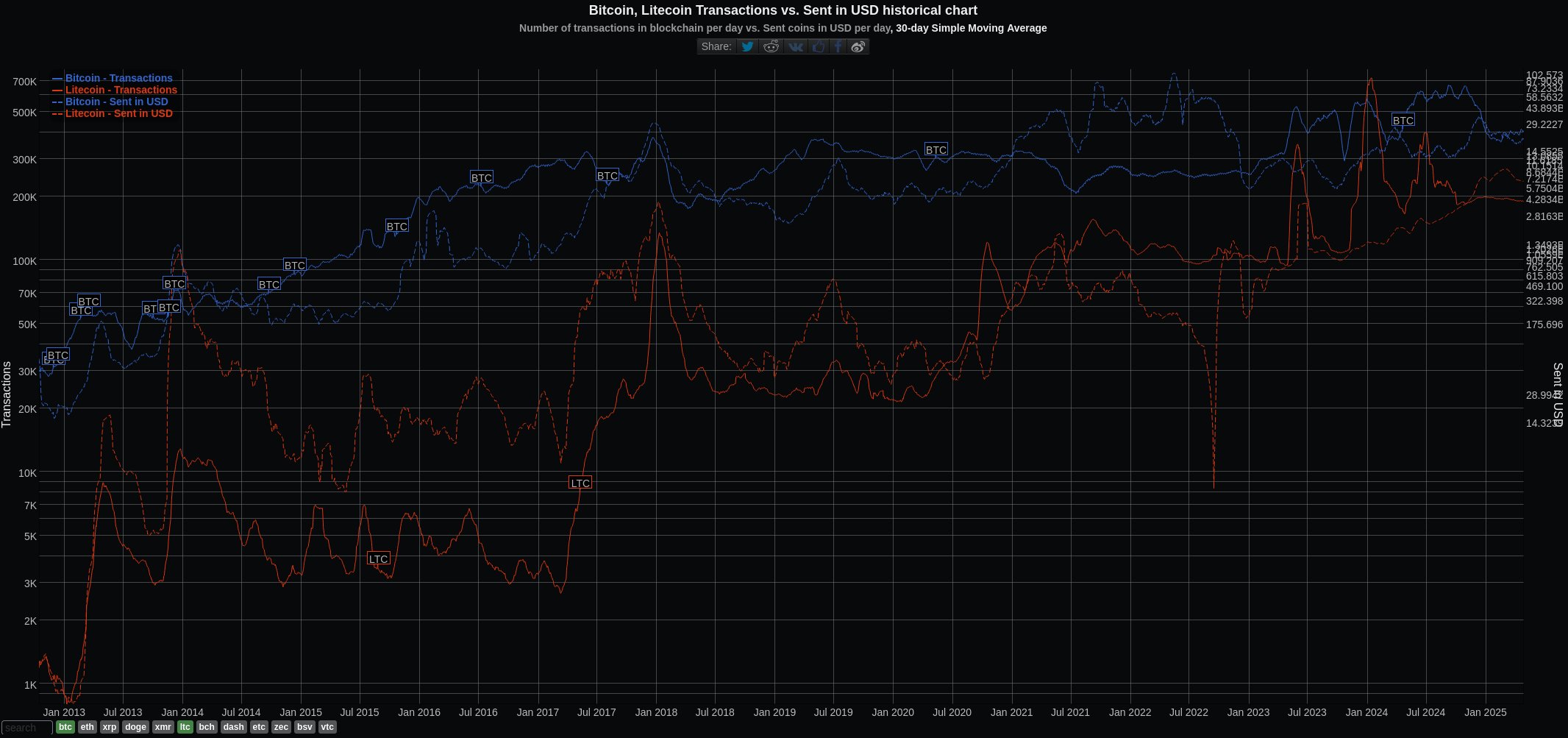

Historical data highlights Litecoin (LTC) gaining significant ground in transaction market share compared to Bitcoin (BTC), a trend that has continued as Bitcoin’s on-chain fees rise.

Since 2017, Bitcoin’s transaction counts have oscillated between around 200,000 and 700,000 (30-day moving average), often deterred by rising transactions costs. During high network congestion, Bitcoin fees have hit upwards of $120 per transaction, leading users to adopt practical alternatives such as Litecoin. By contrast, Litecoin’s faster 2.5-minute block times and Scrypt algorithm dominance enable cheaper, more efficient transactions, typically costing $0.01–$0.10 even during peak usage.

Mispricing digital silver

However, the speculative market has yet to reconcile with the network’s usage and adoption metrics, as Litecoin’s price ($86.29 as of April 2025) lags behind its utility. This serves to exacerbate the price-fundamentals mismatch that’s accelerated since 2021, when Litecoin hit an all-time high of $420.69.

Floor price rises despite miner distribution

Separately, miner reserves have plummeted to 2016 levels, with miners holding 2.02 million coins today compared to the 7 million held when LTC traded at its 2021 highs. This distribution reflects confidence in Litecoin’s long-term value, compounded by the fact that its floor price continues to rise despite market headwinds, a testament to the coin’s resilience and utility.

Buy, trade and exchange Litecoin on reviewed exchanges here.

Disclaimer: the content on this site is not investment advice. Investing is speculative. Your capital is your responsibility.

If you enjoyed reading this article, share it!